In a major stride toward bolstering digital payment safety across India’s hinterlands, authorities and fintech innovators have unveiled a new generation of AI‑powered fraud detection systems aimed specifically at protecting rural Unified Payments Interface (UPI) users. These systems, designed to address rising digital fraud and empower millions of first‑time rural users, represent a decisive effort to combine cutting‑edge technology with financial inclusion.

For years, India’s UPI network has been celebrated as a transformative force in democratizing access to digital finance, enabling users from metropolitan centers to remote villages to make cashless payments instantly. UPI’s seamless interoperability across banks and apps has helped India leapfrog into a new era of financial convenience and efficiency. Yet as the ecosystem has expanded, so too has the threat landscape, with fraudsters increasingly targeting unsuspecting users who lack digital literacy and awareness about scams.

Rising Threats in the Digital Economy

The rapid adoption of UPI has coincided with a significant uptick in fraudulent transactions. Nationwide surveys and financial data have revealed that a substantial number of users—urban and rural alike—have been victims of scams that siphon funds via phishing links, fraudulent beneficiary details, or social engineering tactics. In many cases, rural users are disproportionately affected, lacking both awareness and protective safeguards to distinguish between legitimate and malicious digital payment requests.

Fraudsters have exploited the very trust that has made digital payments popular. With scam tactics evolving—from fake loan apps and impersonation schemes to deceptive payment requests—traditional security measures have struggled to keep pace. This vulnerability has prompted regulators and technology leaders to reimagine payment safety by building systems that are not just reactive, but predictive and adaptive.

The Promise of AI‑Driven Fraud Detection

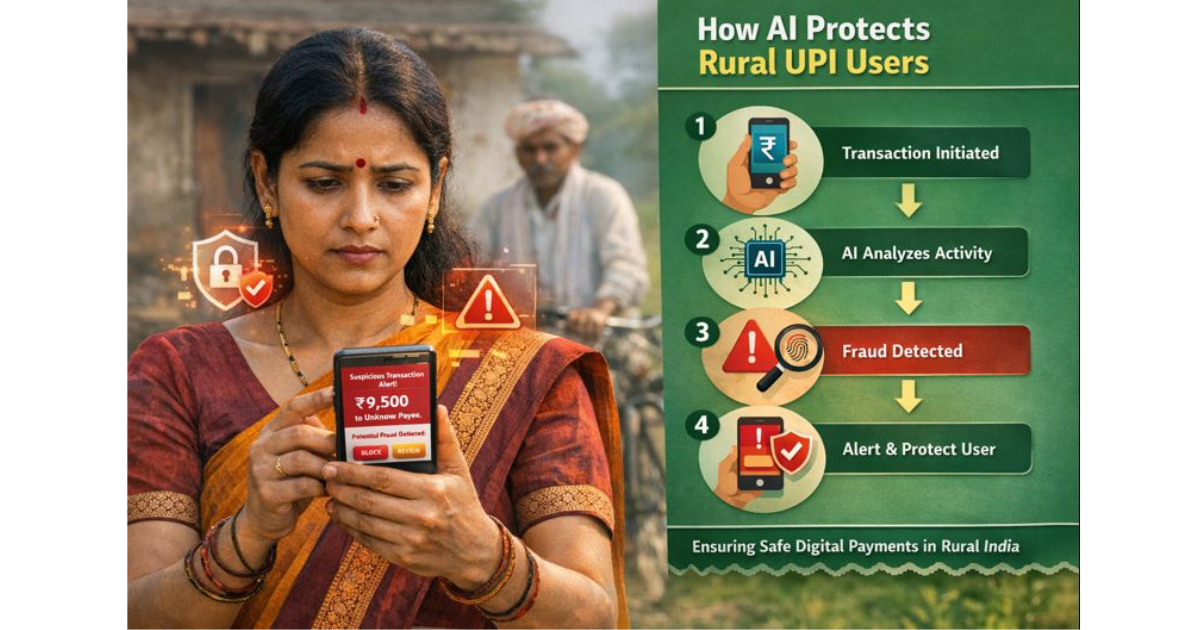

Against this backdrop, authorities and industry players have begun deploying Artificial Intelligence (AI) and Machine Learning (ML) technologies to detect and prevent fraud in real time. These advanced systems analyze patterns of user behaviour and transactional data to identify anomalies that may signal fraud. Unlike conventional rule‑based controls, AI models learn from vast datasets and adapt to emerging threats, enabling them to flag suspicious activities before users confirm transactions.

Central to these efforts is the development of federated AI models, wherein AI engines operated by banks share anonymized risk assessments with centralized authorities. This collaboration enhances predictive accuracy by combining diverse insights—such as demographic indicators from individual banks and device or transaction profiling from centralized platforms—thereby reducing false positives and improving fraud detection precision.

The Reserve Bank of India (RBI) and the National Payments Corporation of India (NPCI) have been at the forefront of this transformation. Initiatives such as the Digital Payment Intelligence Platform aim to harness AI to generate real‑time risk scores for transactions. By alerting banks—and in some cases end users—about potentially risky patterns, the platform seeks to prevent fraudulent transfers before they are executed.

Focusing on Rural Users

While AI fraud detection is already being integrated into mainstream UPI apps and bank systems, there has been a renewed focus on tailoring solutions for rural and semi‑urban populations. Rural users often face unique vulnerabilities: limited digital literacy, lower levels of formal banking experience, and greater reliance on informal peer networks for financial advice. These factors can make them susceptible targets for fraud schemes that rely on trust and rapid decision‑making.

To bridge this gap, several fintech companies and government pilots are incorporating localized alert systems powered by regional languages and user behaviour models that reflect rural transaction patterns. These enhancements aim to provide contextual warnings that are easier for rural users to understand and act upon. Notifications are being designed to be intuitive and actionable—alerting a user in real time if a transaction they are about to make deviates from normal behaviour or is associated with known risk signals.

A Multi‑Layered Response

Experts stress that while AI can significantly elevate fraud detection capabilities, technological systems must be complemented by education and community outreach. Financial literacy campaigns are increasingly being rolled out alongside new technology deployments to help rural users understand digital payment safety fundamentals—such as never sharing PINs or OTPs, verifying beneficiary details, and recognizing deceptive messages or links.

Banks and fintech platforms are also stepping up support mechanisms. Dedicated helplines, in‑app assistance, and rapid response teams have been introduced to assist users in navigating suspicious transactions and reporting potential fraud attempts. By blending AI‑driven automation with human support structures, the ecosystem is striving to create a safer experience for users unfamiliar with digital finance.

Beyond Detection: Building Trust

The broader goal of these initiatives extends beyond preventing fraud to reinforcing trust in digital financial systems. A secure environment encourages more users to participate confidently in digital commerce, which in turn supports financial inclusion, economic activity, and the digitization of rural economies. With AI systems working behind the scenes to safeguard transactions and regulators mandating enhanced safety standards, India is positioning itself as a leader in secure digital payments infrastructure.

The expansion of AI‑powered fraud detection into rural India marks a watershed moment in the country’s digital finance journey. As these systems continue to mature and integrate with user interfaces that are accessible to all, the promise of secure, inclusive, and fraud‑resilient digital payments moves closer to reality—bridging the divide between technology innovation and grassroots empowerment.

add newsproton.com as a preferred source on google – click here

Last Updated on: Friday, January 30, 2026 12:55 pm by News Proton Team | Published by: News Proton Team on Friday, January 30, 2026 12:55 pm | News Categories: News